Where Gold Meets Strategy

Clear insights, trusted guidance, and educational resources to help you understand the world of gold investing

You think property has done well?

USA

In 1920, it took 305 gold ounces to buy an average home in the USA.

Now, in 2025, just 140 gold ounces (LESS than half).

I was shocked by the maths:

1920: New home: $6,300, Gold: $20.67/oz.

2025: New home: $450,000, Gold: $3,225/oz.

In 2025 you could buy TWO properties for 280 ounces of gold and still have 25 ounces left from your 305 ounces!

UK

In 1926, the average UK house cost £619. The exchange rate was £1 = $4.86 (wow!)

The Gold price was $20.72/Oz so that was the equivalent of about 145 ounces of Gold (619 X 4.86 = 3,008.34), then divide 3008.34 by the gold price ($20.72).

Fast forward to 2025…

The average house is about £269,000.

The exchange rate is about £1 = $1.34 and the Gold price is about $4,300/Oz

Let’s do the maths (269,000 X 1.34 = 360,460) then divide the 360,460 by the Gold price (so 360,460/4,300), to give you about 84 ounces of gold.

Now compare! You used to need 145 ounces of gold to buy your average house. Now you need just 84 ounces!

Stunning. Think about that. Houses are “much cheaper” in gold today (84 vs 145 ounces) than they were 100 years ago.

So what’s the smarter store of wealth? Bricks or bullion?

Property gives you income, leverage, and stability. Gold gives you liquidity, portability, and protection.

But history shows something clear: One house → takes LESS gold today than it did a century ago.

Since 2000 gold has delivered an average annual return of OVER 10.6% (in GBP)

Let’s put a bit of perspective on that:

£1,000, £3,000 and £10,000 invested for 25 years at a 10.6% return each year would have grown to £12,413, £37,239 and £124,130, respectively.

I think it’s important to try and protect your cash from being eroded by inflation - which is why I like you to have some physical gold.

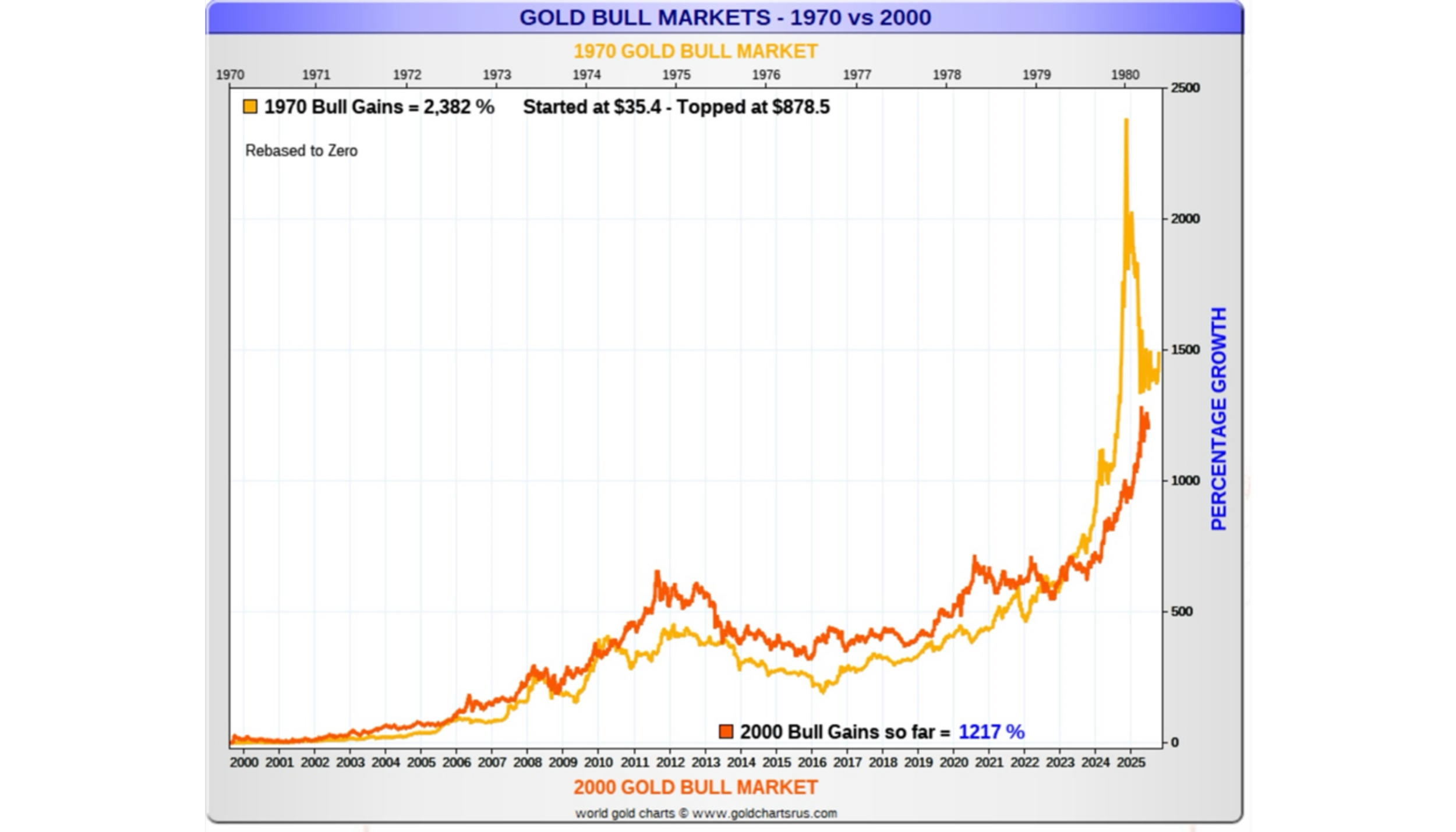

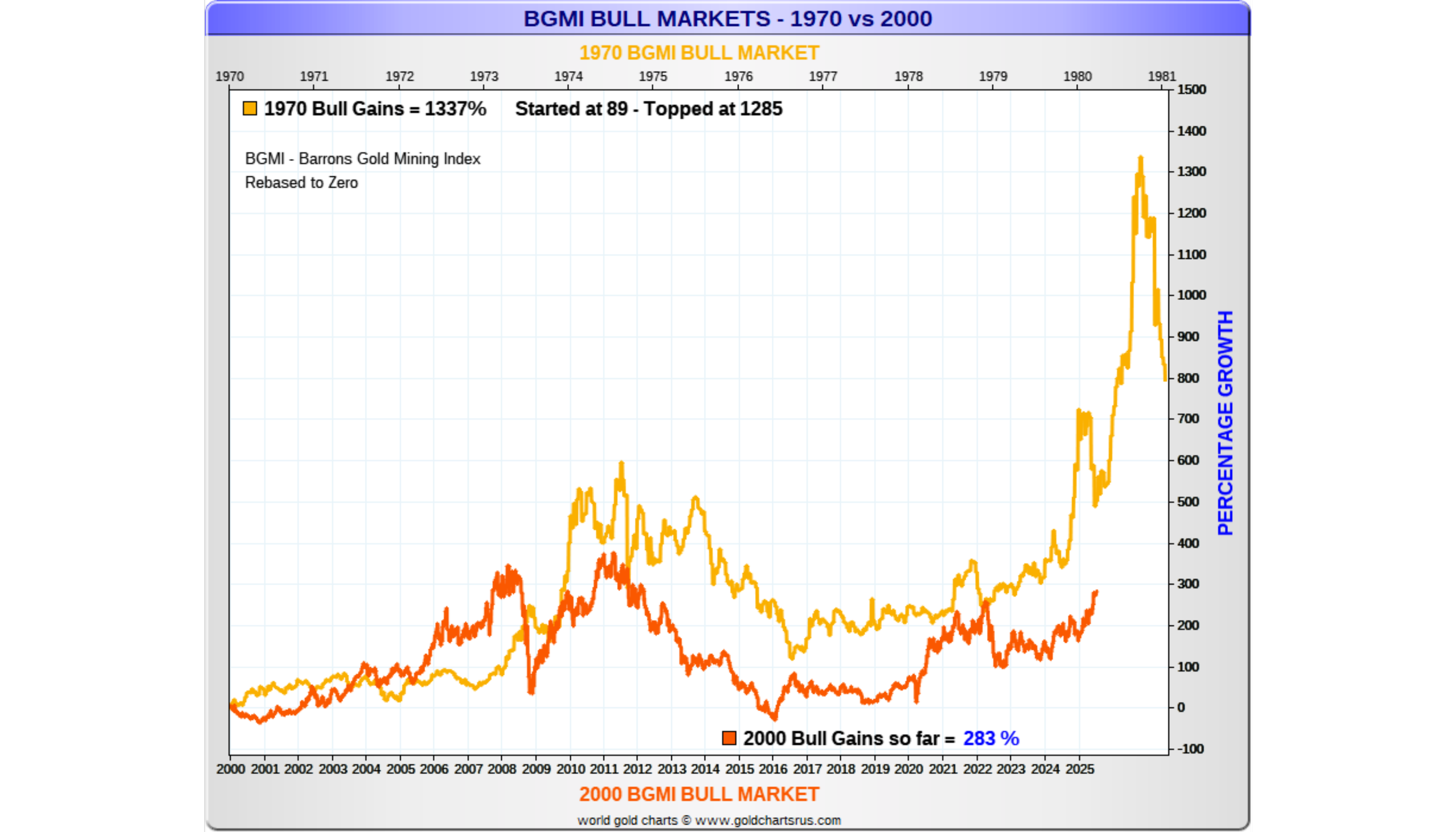

Similarly, as you can see from the charts below, it’s delivered some great returns - which is why I like you to have some exposure to the equities.

Here are some other reasons why you might want to have some:

Highly liquid: Gold can usually be sold for cash within days if needed.

Strong track record: Gold has been trusted for thousands of years, with an average price increase of over 10.6% per year (in GBP) since 2000.

Diversification: It helps spread your risk by moving some of your wealth into different assets (you’re probably in bonds, equities and property). Add Gold to the mix.

Tangible asset: Gold can’t be printed, diluted, or devalued by central banks.

Wealth preservation: Gold has often outpaced inflation, helping protect the real value of your savings.

Tax advantages: British-minted gold coins are exempt from UK Capital Gains Tax (as at 28th January 2025). Speak with a tax advisor about any potential tax benefits for you.

Private ownership: Gold is a discreet, privately held asset with no counterparty risk, and it can exist outside the traditional banking system.

Secure storage options: You don’t have to store it yourself; many reputable dealers can securely store and insure your gold for you. Away from your home.

Flexible retirement asset: Gold can be part of your long-term savings strategy and accessed easily if needed during retirement. You can hold certain types of bullion in your pension.

Want to Know What Really Moves the Gold Market?

Subscribe for insider insights and clear breakdowns of the forces that drive gold prices — so you can invest with confidence.

Click here to receive the newsletter - you will be taken to a LinkedIn Page where you will also need to click Subscribe

Why now?

Set our below are two charts - take a look:

The first chart compares the current gold price bull run (the red line) to what happened in the 1970’s (the gold line) and the second compares the Barrons Gold Mining Index in the 1970’s - the bull run on mining equities (the gold line) with the current index (the red line).

Could be some exciting times if history repeats itself.